TRANSFORMING OVERSIGHT INTO MEASURABLE RESULTS

Fiduciary Oversight & Cost Containment for Employer Health PlansOur fiduciary approach integrates health plan oversight, vendor accountability, and contract transparency. We help employers uncover hidden costs, mitigate risks, and improve EBITDA—while safeguarding employees and protecting board members from liability.

OUR PROCESS

Fiduciary Independence Framework

Deep industry expertise and independent oversight uncover hidden costs and fiduciary risks often overlooked by traditional brokers and consultants.

Our conflict-free approach ensures negotiations serve only employers, driving solutions and savings that conflicted advisors rarely recommend.

A disciplined process includes broker and vendor audits to expose conflicts of interest and highlight opportunities for measurable improvement.

INSIGHTS YOU NEED

Driving Smarter Health Plan Outcomes

FIDUCIARY PROTECTION

We identify critical compliance gaps and conflicts of interest before they become liabilities. Our framework ensures ERISA and CAA duties are met, while ensuring decisions remain defensible in audits or litigation.

PROCUREMENT & NEGOTIATION

Independent data, delivered by experts, gives leverage at the negotiating table. We eliminate broker-driven conflicts, expand vendor options, and secure contracts that reduce costs while protecting fiduciary interests.

data integration & analysis

We transform fragmented carrier and consultant reports into defensible intelligence. Our analytics provide the independent evidence boards and auditors need to guide fiduciary and financial decisions.

vendor audits & Oversight

We hold brokers, claims administrators, pharmacy middlemen, and stop-loss carriers accountable through independent audits. By validating fees, claims, and performance, we remove blind trust and mitigate risk exposure.

SUPPLY CHAIN OPTIMIZATION

We untangle the healthcare supply chain to expose inefficiencies and hidden markups. Optimizing across carriers, pharmacy middlemen, and networks— safeguarding cash flow and strengthening plan performance.

SOLUTION IMPLEMENTATION

We translate strategy into measurable, lasting results. Every solution is executed with documented ROI, strengthening EBITDA, and providing boards with clear evidence of financial savings and risk reduction.

OUR SERVICES

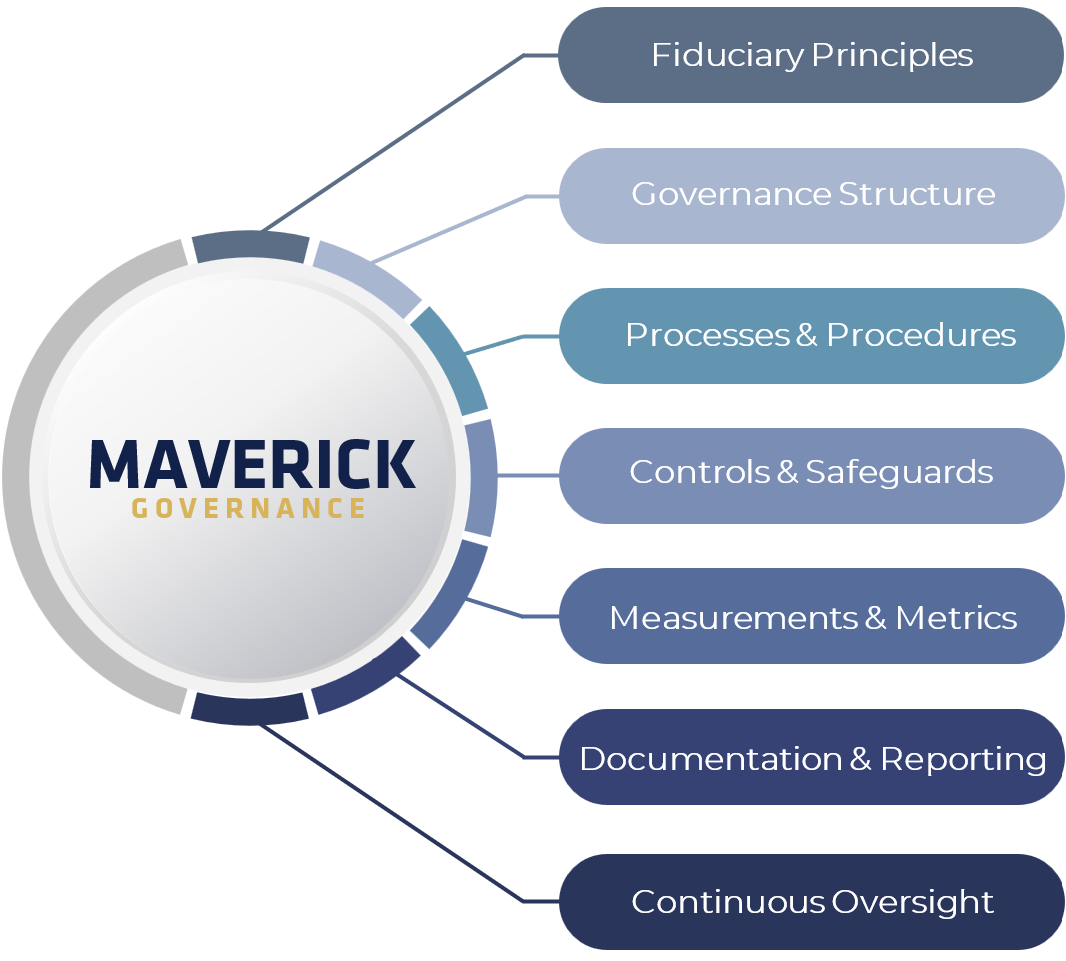

Maverick corporate health plan governance

- governance & fiduciary oversight

- board-level reporting & Dashboards

- healthcare rfp & procurement (broker selection, pharmacy VENDOR, claims admin. & stop-loss)

- healthcare contract negotiation & transparency

- data access & full Audit Rights Negotiation

- financial reconciliation of claims & reserves / cash flow management

- erisa & CAA compliance audits

- point Solutions Procurement & ROI Tracking

- vendor fee & compensation auditS

- vendor performance & compliance audits

- third-party vendor audits

- Independent plan benchmarking & market analysis

- Plan Compliance & Fiduciary Risk Testing

SEE HOW WE’RE DIFFERENT

DISCOVER MAVERICK HEALTH PLAN GOVERNANCE

Our fiduciary approach to health plan governance improves EBITDA by uncovering hidden costs and reducing liabilities. In under 90 days, Maverick helps employers control expenses, safeguard employees, while protecting board members and plan sponsors from risk.